Make money and TRAVEL THE WORLD

Have you ever asked yourself, ‘can I make more money doing this job overseas?’ or ‘I wonder how I would get along in Australia? ‘or maybe just ‘how can I get the hell out of working on Teesside?’. Well you’re not the first. Perhaps 20% of so of all the people in the UK integrity industry (that’s NDT, inspection and all jobs in-between) have worked overseas for a significant period, say more than 6 months at time, with even more shipping out for shorter periods About half of these become what you might call true expatriate workers (known as ex-pats), leaving the UK for years at a time, at the same time taking advantage of whatever tax savings are available.

As you might expect, various websites have sprung up to inform the information-hungry ex-pat. Have a look at www.expatnetwork.com and www.expatcareers.com amongst others. True to form, the UK tax authorities produce leaflets to explain your tax situation and the good old Foreign and Commonwealth Office (or FCO) has, since 1782 provided guidance as to places where its best not to go if you are partial to a little imperialist banter of an evening and waving of the Union flag. The USA Department of State (tagline ‘Diplomacy in action’) produces similar information for their citizens, and may occasionally differ with the opinions of the UK Diplomatic Service (who run the FCO) in how they view the risk of travel to foreign soil.

Sunshine and showers

Sunshine and getting away from the rain is a bonus of many ex-pat locations. Before you pack the sun cream along with your tools and computer however bear in mind that the UK ranks only 70th (from 170 or so countries) in terms of the amount of rainfall it gets per year. Brunei, The Bahamas, Barbados, Norway, Thailand, Switzerland, Sri Lanka, Trinidad and Jamaica are only some of the 69 countries which are, overall, wetter than the UK. That’s good to know.

Let’s get back to money

The 1970s were a long time ago. Back then, in the heyday of oil exploration in the North Sea, UAE or Gulf states, ex-pat salaries could be three or four times that of a similar job in the UK, if you could have found one. Colloquially, earning the equivalent of the cost of a small new car per week was the talk of contract ex-pats in the Oil & Gas integrity industry. All tax-free, if you were careful. Fast-forward this to current times and that’s a cool £500,000 per year, allowing for a bit of holiday or enforced downtime. You had to wear flared trousers though and, if you were working on North Sea oil contracts, persuade the Norwegians you were resident in the UK and the UK tax authorities you were resident in Norway, at the same time.

Today, the only way you can get this kind of money as an ex-pat is to work where no-one else wants to. This means war zones, kidnap-friendly republics and locations where you are expected to be on good terms with your modern piracy neighbour. This helps in case you are invited to stay with them longer than you expected whilst your relatives source £10m and a couple of rocket launchers to expedite your homecoming.

There’s still good money to be made in expat positions but a realistic ceiling is probably about twice the UK-level salary, caused by a decrease in overseas rates but also an increase in UK rates. The UK now has higher salaries than about 80% of the countries in the world where salary data is available (about half of them) and so, worldwide is in the upper 10% when it comes to global salary rate. Out of interest, some countries where average salaries are higher are, in no particular order, Switzerland, Norway, UAE, Qatar, Iceland, Singapore, Australia, Denmark, USA, Finland, Netherlands, Hong Kong, Germany, Japan and Canada.

Note that salary rates you can get as a ‘temporary’ ex-pat don’t always relate to the average salary in your country of destination. If you are working ‘month-on-month off’ in a foreign country and living in an employer’s camp when you are there then you are not really involved in the economics of the country in terms of pay rate or the cost of living. It’s therefore down to supply and demand, and negotiation as to how much your presence there is actually ‘worth’ to the employer.

Costs of living

If you become a permanent ex-pat overseas, returning to the UK only to visit relatives or remind yourselves of the seemingly endless summers or misty heather-covered vistas of your youth then you are going to have to balance whatever inflated pay you get with the actual cost of living where you will be spending most of it.

No-one has the same spending pattern, but it’s fair to say that there are a lot of similarities when you look at UK ex-pat lifestyles in foreign countries. People who know these things reckon personal expenditure balances out from combination of six categories; food, housing, clothes, transportation, personal care and entertainment. Housing and food tend to take priority; ex-pats being happy with t-shirt and shorts for most of the time, and driving the employer’s thoughtfully-provided pick-up truck. HOT TIP…when you get the company’s vehicle application form to fill in, type ‘Ford F350 Super-duty XLT (blue jeans metallic colour) 6.2L SOHC 2-valve Flex Fuel V8, must have tan leather’ in the ‘vehicle required’ box. It’s always good to travel in style, as long as you’re not paying for the fuel.

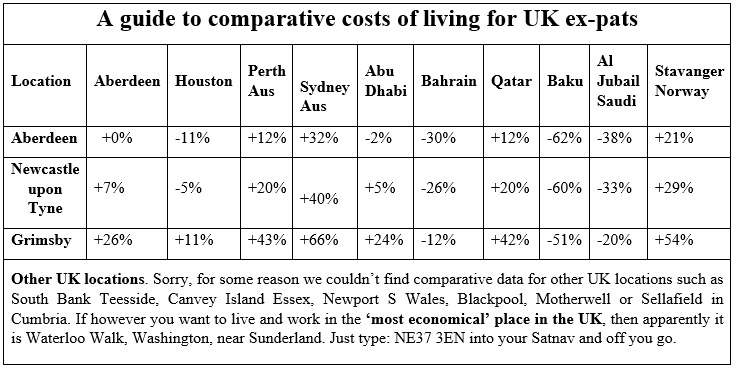

Getting back to the comparative costs of living, there’s good websites covering this; www.expatistan.com is worth a look and there are a couple of similar ones. What you need of course is a table showing an easy comparison of what it will cost you to live elsewhere compared to where you are now. After much searching, here it is below. To use the table, start in the left hand column in the row indicating where you are now and then just move along the row to see the comparative increase or decrease in living costs at the other destinations. The precise figure relevant to you will depend on your lifestyle but overall, the figures you see shouldn’t be far out. You can draw your own conclusions but that attractive-looking move from Grimsby to Sydney for an attractive-sounding 50% salary increase may not prove such a good deal after all.

Coming home

A large percentage of UK ex-pats working in the plant integrity industry return home, sooner or later whilst still in their working lives; about 80% would be a fair guess. In addition, of those that progress to being an ex-pat in retirement, then a third of those return also. It just seems to be the way things are. On the positive side, long-serving ex-pats who return after 15-20 years overseas normally look back on it as a positive experience and the way to make a bit of money.

Bringing your money back to the UK

Assuming you don’t spend too much of it on 4-WD trucks and gold jewellery (Dubai), a yacht (Perth) or golf stuff (anywhere remotely ex-pat-like) then you will be wanting to eventually bring the remnants of your hard-earned earnings back to the UK. The UK tax rules are understandably a bit tight. If you were abroad for less than a full tax year (6 April to 5 April the following year) then you are usually classed as being a UK resident, even when you weren’t. This means you have to hand over UK tax on all the foreign income you earned for the entire time you were away.

If you return to the UK within 5 years, you may have to pay tax on certain income or gains made while you were non-resident but this doesn’t include wages or other employment income.These rules (called ‘temporary non-residence’) apply if both:

- you return to the UK within 5 years of moving abroad (or 5 full tax years if you left the UK before 6 April 2013)

- you were a UK resident in at least 4 of the 7 tax years before you moved abroad

At this stage, contact your accountant for complete information. We are not accountants, but we do employ a few and they’re all good at keeping in touch with current changes in tax rules at our expense. You can ask their advice on the Resident-v- Domicile status if you need help working out which country you’re domiciled in. Read chapter 5 of HMRC’s guidance notes on ‘Residence, Domicile and the Remittance Basis’ also. It’s on their website. You don’t always have to be where you actually are, if you see what I mean.

Have a look at our talking about tax article for some further info.

Thank you

Thank you for reading this part of Matthews HEAD OFFICE: MoneyBIT. We are sorry if you were looking for lists of job offers of £200,000 per year for 3 days per week for NDT technicians and plant inspectors in the Cayman Islands .There are a few around (although not in the Caymans) but you have to go and really dig them out. They are unlikely to come looking for you by appearing on internet recruitment agency websites.

Matthews Integrity Hub: HEAD OFFICE is OPEN EVERY DAY….0730 – 2200 Monday – Sunday…That’s correct, all week, every week, including holidays

If we happen to miss your call, leave a message and we will call you back just as soon as we pick it up. Sorry, there’s no automated messages, call queueing, voice recognition tools or canned music. Try it and see.

If we happen to miss your call, leave a message and we will call you back just as soon as we pick it up. Sorry, there’s no automated messages, call queueing, voice recognition tools or canned music. Try it and see.

CONTACT US

Tel: 07746 771592 help@matthewsintegrity.co.uk